Set alerts to when spending exceeds certain limits and also set sub-limits to spend. It is possible to set budgets for credit and debit card spends and also tweak them as time goes by, thus incorporating greater flexibility to its working. This would give for easy and quick reconciliation between the spending accounts and help keep a tab on the spending part of accounting.

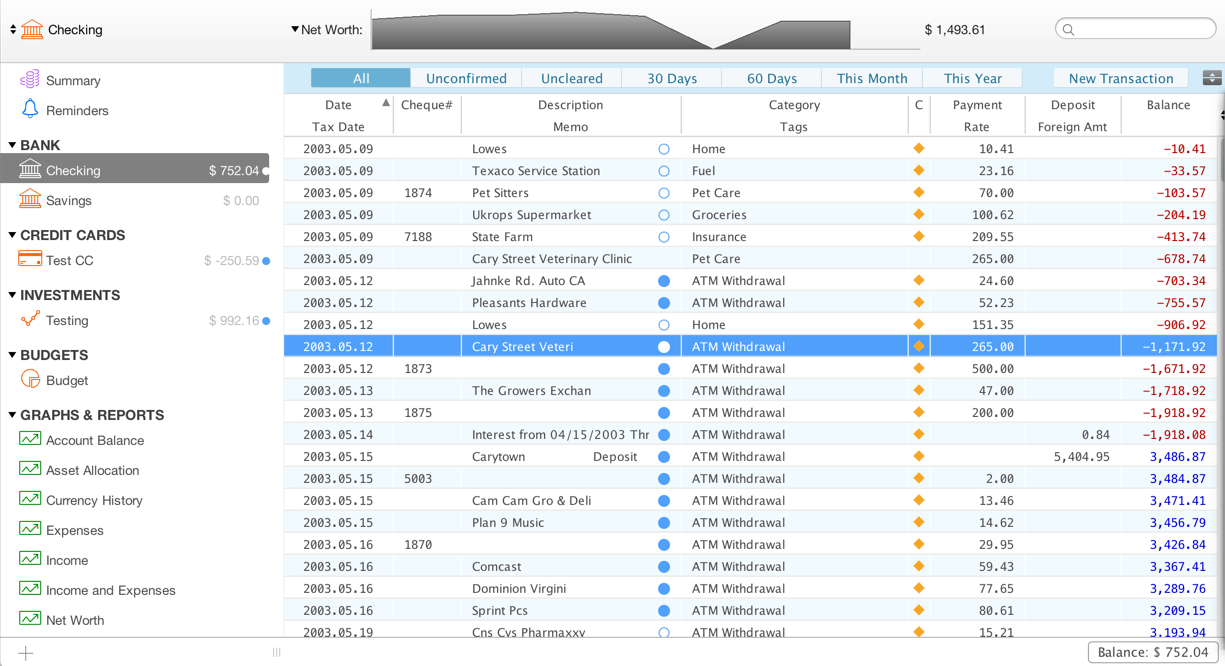

With Mint, it is possible to like the customer credit and debit cards. It is one of the simplest and easiest to set up and has all the features located at the center of the screen as people boot into the system. There are an array of features that helps with keeping accounts from different sources like banks, credit cards, brokerages, financial institutions, and the like.

#Moneywell budget software software

Mint is one of the oldest and better-known budgeting software available in the market. If you use the export feature it could save hours of data entry. A particular time that CSV comes into play is when migrating from one software to another accounting software. This helps the user integrate the software with spreadsheets and allows greater flexibility in usage most of the time.

This provides for extra safety and restricted access to others. It is necessary for the budgeting software to encrypt the data. Another issue with information security is the issue of encryption of data. This makes the software secured from unauthorized use as far as possible.

#Moneywell budget software password

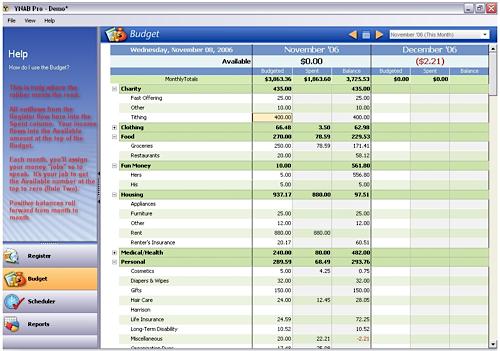

In case you don’t have this feature on the software you use, we advise you to set a password for the computer. The system must ask for a password at startup and each time the computer comes out of hibernation. Information Security: A password is a necessity when it comes to using accounting software.Moreover, if you’re going to use the budgeting software for filing the tax returns, it helps to have an application that is flexible enough with the report preparation. Some of the software give flexible figure reports which make it more simple for the user to understand. Budget Reports: The typical budgeting software provides detailed reports which you can study.These limits can be flexible so that it is possible to override a set limit in case of emergencies. It would be permissible to set spending limits warning to each of the categories and limit any overreach that might occur. Adaptable Limits: With many of the budget software, it is possible to set out limits to spending and under different categories or heads.It would be possible to further categorize the expenditure into sub-categories which make for closer scrutiny of the sheets. The advantage of flexible budget categories is that it is possible to change headings as the needed and get a clearer picture as spending habits change. Budget Categories: These are heads under which spending or the income is split.Here are the main advantages of using some of the best budgeting apps or software: Over a period of time, it is possible to check if the user is exceeding his spending, and what can be saved for the future after taking care of future expenses. It’s possible to separate the expenditure from the income and literally feel how the money is being spent every week or every month. There are indeed advantages to using budgeting software so be sure to use the best budgeting apps there are.

0 kommentar(er)

0 kommentar(er)